- Topic

58k Popularity

33k Popularity

27k Popularity

32k Popularity

76k Popularity

- Pin

- 🎉 The #CandyDrop Futures Challenge# is live — join now to share a 6 BTC prize pool!

📢 Post your futures trading experience on Gate Square with the event hashtag — $25 × 20 rewards are waiting!

🎁 $500 in futures trial vouchers up for grabs — 20 standout posts will win!

📅 Event Period: August 1, 2025, 15:00 – August 15, 2025, 19:00 (UTC+8)

👉 Event Link: https://www.gate.com/candy-drop/detail/BTC-98

Dare to trade. Dare to win. - 📢 Gate Square Exclusive: #WXTM Creative Contest# Is Now Live!

Celebrate CandyDrop Round 59 featuring MinoTari (WXTM) — compete for a 70,000 WXTM prize pool!

🎯 About MinoTari (WXTM)

Tari is a Rust-based blockchain protocol centered around digital assets.

It empowers creators to build new types of digital experiences and narratives.

With Tari, digitally scarce assets—like collectibles or in-game items—unlock new business opportunities for creators.

🎨 Event Period:

Aug 7, 2025, 09:00 – Aug 12, 2025, 16:00 (UTC)

📌 How to Participate:

Post original content on Gate Square related to WXTM or its - 🎉 Attention Alpha fans! Alpha’s latest TAG airdrop goes live today at 10 AM—first come, first served!

💰 Don’t forget to share your airdrop or points screenshot on Gate Square with the hashtag #ShowMyAlphaPoints# for a chance to win a share of the $200 token mystery box!

🥇 Top points winner: $100

✨ 5 outstanding posts: $20 each

📸 Pro tips:

Add a caption like “I earned ____ with Alpha. So worth it”

Share your points-earning tips or redemption experience for a better chance to win!

📅 Activity deadline: August 10, 18:00 UTC

Let’s go! See you tonight: https://www.gate.com/announcements/article - 🎉 The #CandyDrop Futures Challenge is live — join now to share a 6 BTC prize pool!

📢 Post your futures trading experience on Gate Square with the event hashtag — $25 × 20 rewards are waiting!

🎁 $500 in futures trial vouchers up for grabs — 20 standout posts will win!

📅 Event Period: August 1, 2025, 15:00 – August 15, 2025, 19:00 (UTC+8)

👉 Event Link: https://www.gate.com/candy-drop/detail/BTC-98

Dare to trade. Dare to win.

[Forex] Forecasting the Dollar/Yen for August and the First Week | Tsune Yoshida's Forex Weekly | Moneyクリ Money Partners Securities' Investment Information and Useful Media for Money

July Review = Rise of the Dollar/Yen to 150 Yen, but Plummeted on August 1

Dollar/Yen, rising to the highest level since the end of March 2025 = diverging from the interest rate difference

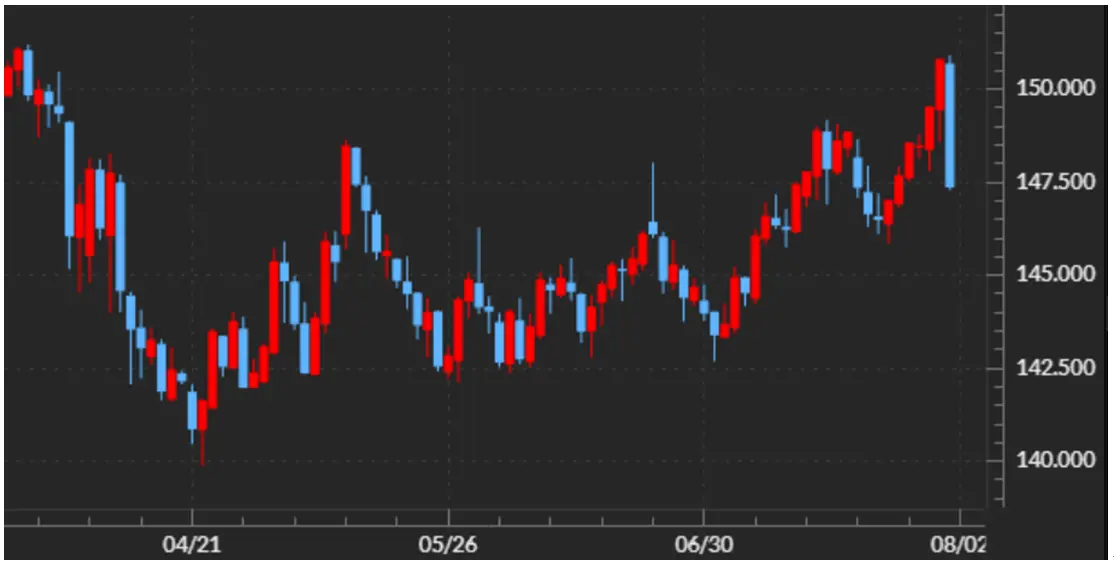

In July, the Dollar/Yen rose significantly, reaching nearly 151 yen by the end of the month, marking the highest level since the end of March. However, following the announcement of July's U.S. employment statistics on August 1, which were weaker than market expectations, it reversed course and plummeted to the 147 yen level (see Chart 1).

[Figure 1] USD/JPY Daily Chart (March 2025 - ) Source: Money Exchange Trader FX

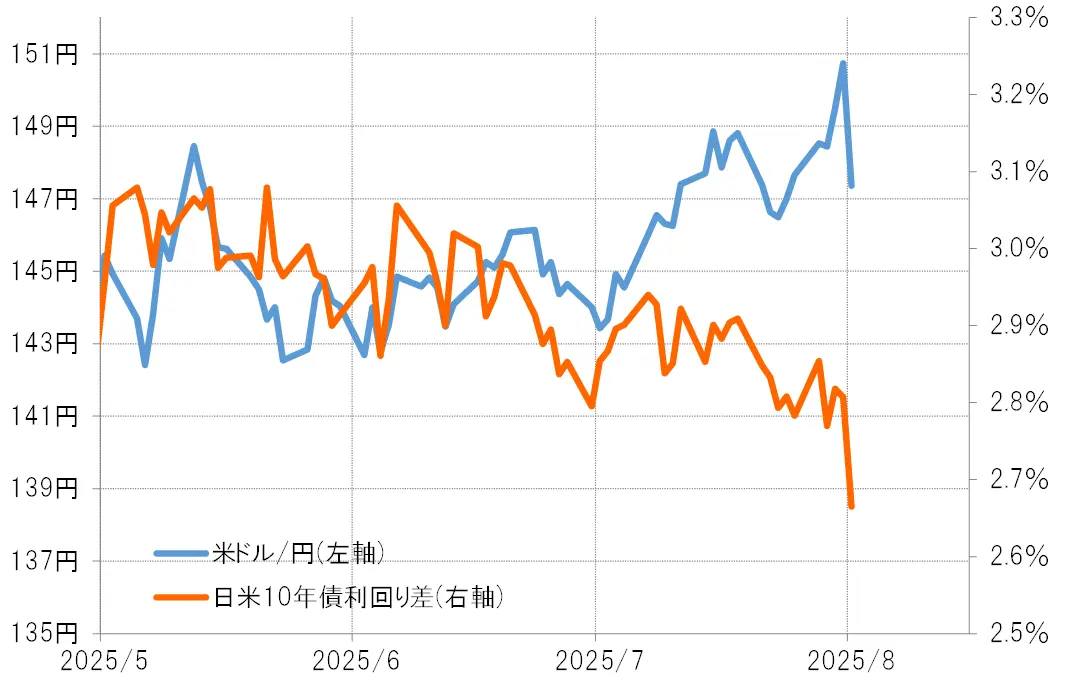

In July, the major factors for the significant rise of the Dollar/Yen included the unexpectedly strong results of the U.S. employment statistics for June, the coalition government's major defeat in the Japanese House of Councillors election, and the monetary policies of the U.S. and Japan at the end of the month. However, this substantial appreciation of the Dollar and depreciation of the Yen was largely disconnected from the interest rate differential between the U.S. and Japan (favoring the Dollar and disadvantaging the Yen) (see Chart 2). In fact, the interest rate differential between the U.S. and Japan in July was rather on a shrinking trend.

Source: Money Exchange Trader FX

In July, the major factors for the significant rise of the Dollar/Yen included the unexpectedly strong results of the U.S. employment statistics for June, the coalition government's major defeat in the Japanese House of Councillors election, and the monetary policies of the U.S. and Japan at the end of the month. However, this substantial appreciation of the Dollar and depreciation of the Yen was largely disconnected from the interest rate differential between the U.S. and Japan (favoring the Dollar and disadvantaging the Yen) (see Chart 2). In fact, the interest rate differential between the U.S. and Japan in July was rather on a shrinking trend.

[Figure 2] The transition of the Dollar/Yen exchange rate and the difference in 10-year bond yields between Japan and the U.S. (from May 2025 onwards) Source: Created by Monex Securities from Refinitiv data.

Source: Created by Monex Securities from Refinitiv data.

The justification for the depreciation of the yen to 150 Yen was "two speculative yen sell-offs".

The main actors that justified the appreciation of the US Dollar and the depreciation of the yen in July 2025 were probably two speculative forces buying US Dollars and selling yen. One was the selling of yen due to hedge funds (hereafter referred to as hedge F) closing their yen buying positions. The other was the expansion of US Dollar buying and yen selling by individual Japanese investors and others, based on the interest rate differential favoring the US Dollar over the yen.

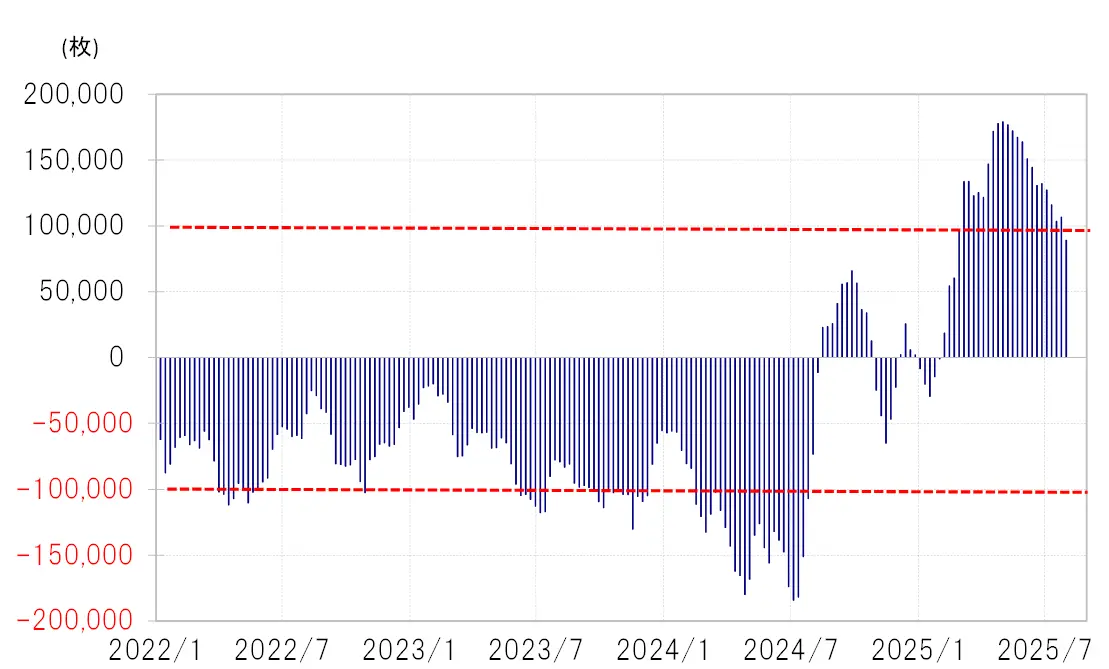

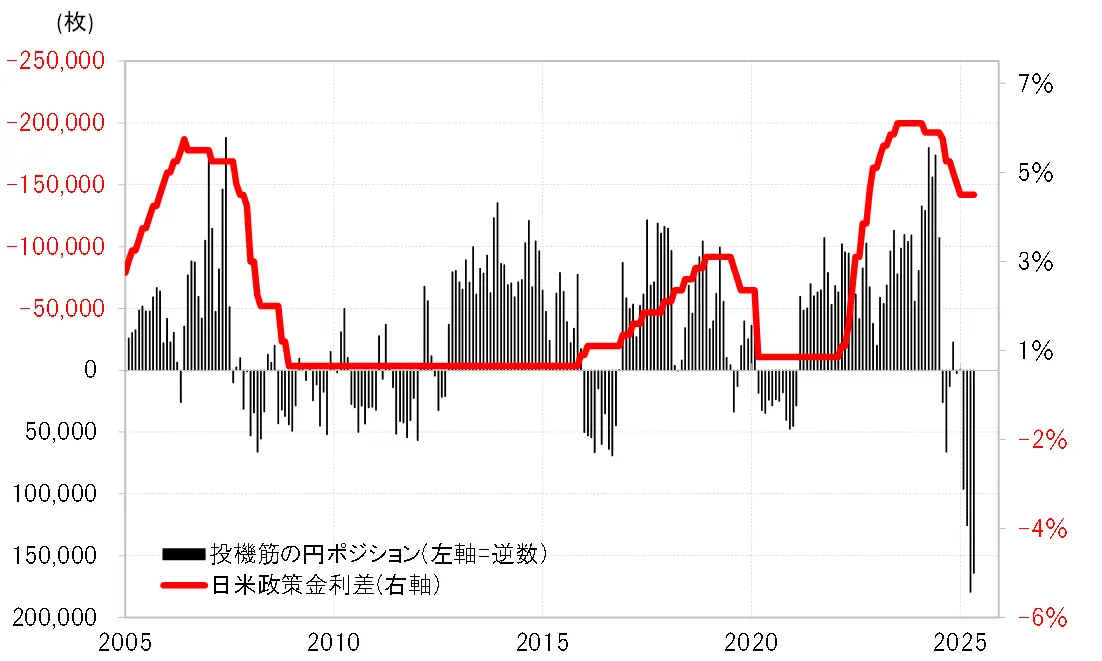

The CFTC statistics reflecting the trading of hedge funds show that the speculative long positions in yen expanded to an unprecedented scale of over 170,000 contracts (short positions in Dollar) by May 2025, but by the end of July, it had nearly halved to 89,000 contracts (see Chart 3). This large-scale reduction in long positions in yen likely contributed to the rise of the Dollar and the depreciation of the yen in July.

[Chart 3] CFTC Statistics of Speculative Yen Positions (January 2022 - ) Source: Created by Monex Securities from Refinitiv data.

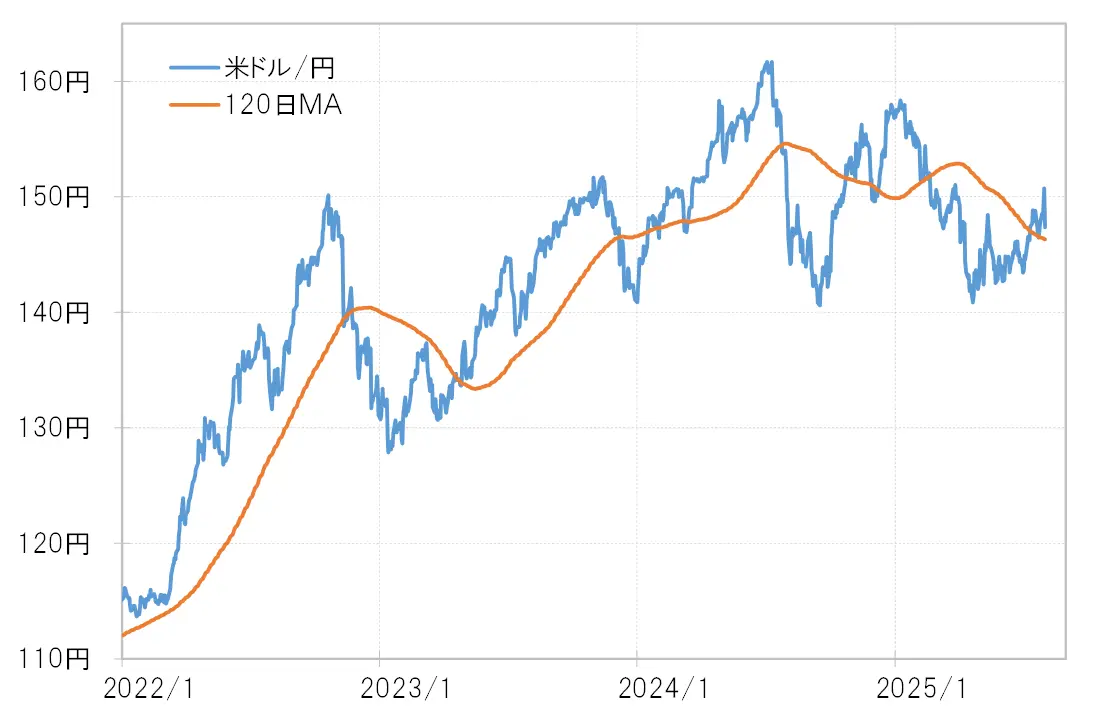

Why did Hedge Fund F's yen buying position shrink significantly? It is believed that this was largely due to the impact of falling below the breakeven point, which has caused unrealized losses to expand. The breakeven point for Hedge Fund F's yen buying position may be indicated by the 120-day moving average (MA) of the USD/JPY, and from mid-July 2025, there has been an increase in trends of a strong dollar and weak yen (see Chart 4). Given these factors, it is possible that there has been an increase in yen selling to avoid further losses in the yen buying position.

Source: Created by Monex Securities from Refinitiv data.

Why did Hedge Fund F's yen buying position shrink significantly? It is believed that this was largely due to the impact of falling below the breakeven point, which has caused unrealized losses to expand. The breakeven point for Hedge Fund F's yen buying position may be indicated by the 120-day moving average (MA) of the USD/JPY, and from mid-July 2025, there has been an increase in trends of a strong dollar and weak yen (see Chart 4). Given these factors, it is possible that there has been an increase in yen selling to avoid further losses in the yen buying position.

[Chart 4] US Dollar/Yen and 120-day MA (January 2022 - ) Source: Created by Monex Securities from data provided by Refinitiv.

Source: Created by Monex Securities from data provided by Refinitiv.

The significant interest rate differential continues to create a favorable structure for expanding yen selling due to the weakness of the yen.

Although the above hedge fund's yen buying position has been reduced from its peak, it is still arguably unreasonable when viewed from the perspective of the significant interest rate differential disadvantage of the yen (see Chart 5). Therefore, the expansion of the hedge fund's yen buying may be exceptional even among speculative traders engaging in short-term trading. Japanese individual investors and FX traders may have considered the significant interest rate differential disadvantage of the yen and could still be expanding favorable yen selling.

[Figure 5] CFTC statistics on speculative yen positions and the interest rate differential between Japan and the United States (2005 - ) Source: Created by Monex Securities based on data from Refinitiv.

To summarize, the rise of the Dollar/Yen to 150 yen in July greatly exceeded what could be explained by the interest rate differential between Japan and the United States. However, it seems that this was realized mainly due to two speculative Yen sell-offs: the Yen selling associated with the unwinding of Hedge Fund's long Yen positions and the aggressive Yen selling by Japanese individual investors, considering the unfavorable Yen position due to the interest rate differential.

Source: Created by Monex Securities based on data from Refinitiv.

To summarize, the rise of the Dollar/Yen to 150 yen in July greatly exceeded what could be explained by the interest rate differential between Japan and the United States. However, it seems that this was realized mainly due to two speculative Yen sell-offs: the Yen selling associated with the unwinding of Hedge Fund's long Yen positions and the aggressive Yen selling by Japanese individual investors, considering the unfavorable Yen position due to the interest rate differential.

August Highlights = Was "The Stronger-Than-Expected U.S. Economy" Correct?

After the release of the US employment statistics, reevaluate the assessment of the US economy.

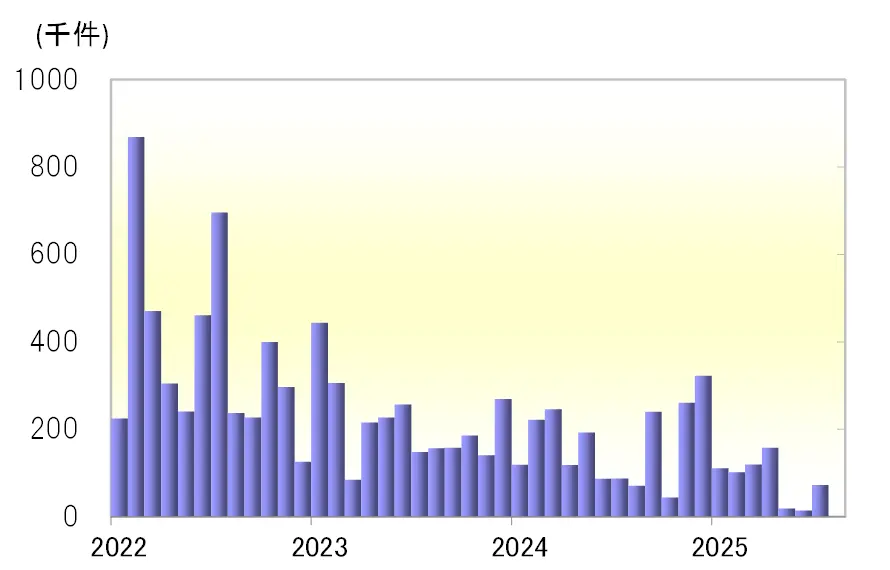

The rise of the US Dollar and the depreciation of the yen suddenly reversed at the beginning of August. The major trigger for this was the US employment statistics announced on the 1st. Within this, the NFP (Non-Farm Payroll) for July was weaker than expected, and the data for May and June was significantly revised downward, leading to a shift in the perception of the US labor market as "stronger than expected" (see Chart 6).

[Figure 6] Trends in NFP (Non-Farm Payroll Employment) (2022–) Source: Created by Monex Securities from Refinitiv data.

The significant backdrop for the rise of the US Dollar and the depreciation of the yen from 139 yen in April 2025 to 150 yen in July was, I believe, the unexpected strength of the US economy, including the labor market. Although the growth rate of US real GDP was negative on a year-on-year basis in the first quarter of 2025, the preliminary value for the second quarter was a high figure of 3%.

Source: Created by Monex Securities from Refinitiv data.

The significant backdrop for the rise of the US Dollar and the depreciation of the yen from 139 yen in April 2025 to 150 yen in July was, I believe, the unexpected strength of the US economy, including the labor market. Although the growth rate of US real GDP was negative on a year-on-year basis in the first quarter of 2025, the preliminary value for the second quarter was a high figure of 3%.

At one point, it was believed that inflation would reignite mainly due to the tariff policies of President Trump, while the U.S. economy was slowing down, and in the worst-case scenario, there was a risk of falling into "stagflation," where rising prices and recession occur simultaneously. However, without these being confirmed in actual figures, stock prices have rather updated their all-time highs.

The U.S. employment statistics announced on August 1 have prompted a reevaluation of whether the recent view of a "stronger-than-expected U.S. economy" was accurate. In this context, the U.S. Dollar/Yen in August will hinge on assessing the U.S. economy, and if the U.S. economy, including the labor market, deteriorates to the point where an early resumption of interest rate cuts is necessary, the U.S. Dollar's upside will also be weighed down by falling stock prices and declining U.S. interest rates.

August USD/JPY forecast = 143 to 150 Yen, is there a possibility of Yen strengthening?

As another guideline, I would like to focus on whether the Dollar will depreciate and the Yen will appreciate based on the 120-day moving average of the Dollar/Yen, which is currently fluctuating in the lower 146 yen range. This could be the breakeven point for Hedge Fund F's Yen buying position, so if the Dollar depreciates and the Yen appreciates below the 120-day moving average, the Yen selling associated with Hedge Fund F's position closure may slow down. Taking all this into account, I predict that in August, the Dollar/Yen will range between 143 and 150 yen, showing a reversal back to Dollar depreciation and Yen appreciation, unlike July.

Forecast range for USD/JPY from 8/4 to 8/8 = 145 to 150 Yen

Following the announcement of the U.S. employment statistics for July on August 1, the need to reassess the evaluation of the U.S. economy has emerged as a theme. As a result, the U.S. economic indicators, particularly the ISM non-manufacturing index and employment-related metrics scheduled for the 5th, are expected to attract attention.

The USD/JPY plummeted over 3 yen from the 150 yen range to the 147 yen range on the 1st, which may limit any potential rebound in the near term. On the other hand, attention is focused on whether it will break below the early 146 yen range of the 120-day MA. As long as it remains above the 120-day MA, the selling of yen due to the unwinding of the hedge fund's yen long positions may limit the downside of USD/JPY. However, if it breaks below this level, the risk of decline will expand, making it difficult to trigger a stronger dollar and weaker yen. Taking this into account, I forecast the USD/JPY for this week (week of August 4) to be between 145 and 150 yen.